🛞 Covered Call Trade Management

Wednesday Feb. 18, 2026 Managing OSCR

Hello everyone,

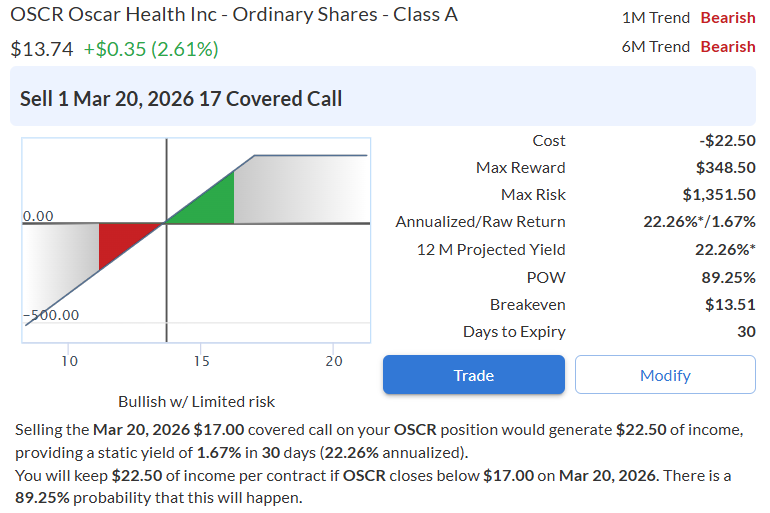

With earnings now in the rearview mirror and the stock beginning to stabilize, I’m seeing early signs that momentum could start to build here. While the broader trend has been choppy, price is attempting to regain footing and could be setting up for a move higher if traction continues.

Given that backdrop, I’m managing the position by writing a covered call to generate income while the stock works to appreciate. This allows me to collect premium up front, lower my effective cost basis, and stay disciplined as the setup develops.

If the stock continues higher and approaches my strike, I’m comfortable letting it go at that level. If it stalls or consolidates, I keep the premium and repeat the process.

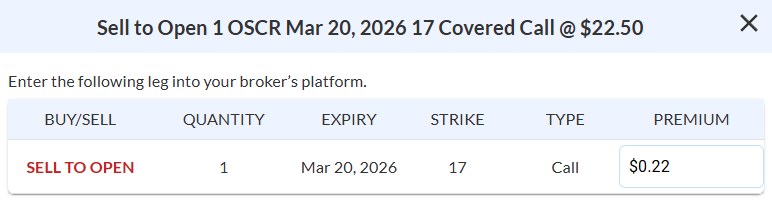

Here’s how I’m structuring it.

*Disclaimer: The examples in The Options Oracle are my opinion, not financial advice.