How I Scan, Analyze, and Trade Cash-Secured Puts for Consistent Returns

From Scan to Strategy: My Complete Analysis of MSTR, YINN, and SMCI

Hey Traders and Investors,

Every day, I scan for short-term opportunities to generate premium through cash-secured puts—one of my favorite strategies for consistent income. But I don’t stop there. If I get assigned, I’ve got a plan to maximize the return with capital appreciation and, of course, selling covered calls to keep the cash flow rolling.

In today’s article, I want to show you exactly how I find these trades, evaluate their potential, and make the decision to pull the trigger or pass. From my scan on Friday, I took the top three of the 157 names that popped up on my radar: Microstrategy ($MSTR), Direxion China ETF ($YINN), and Super Micro Computer ($SMCI).

☕ Grab a coffee, and let’s break this down!

🔍 The Scan:

These three tickers—MSTR, YINN, and SMCI—are likely considered good candidates for cash-secured puts based on specific criteria that align with an optimal selling strategy. Here's the breakdown of the reasons why these stand out:

1. High Annualized Premium Yield (APY)

MSTR: APY 129%

YINN: APY 128%

SMCI: APY 127%

The APY measures the potential annualized return from selling the cash-secured puts relative to the cash you must set aside to secure the position.

High APYs indicate you are receiving substantial premium relative to the risk you're taking, making these options more attractive.Not

*Note: Annualized yields assume you can repeat the same trade every month for an entire year without fail which is unrealistic because that’s not how the market works. What I’m actually focused on is the short-term premium I can capture in the next 30 days or less.

2. Reasonable Strike Prices Relative to Current Price

MSTR:

Current Price: $408.67

Strike Price: $390

The strike price is $18.67 (4.5%) lower than the current price.

YINN:

Current Price: $29.09

Strike Price: $28.00

The strike price is $1.09 (3.75%) lower than the current price.

SMCI:

Current Price: $36.45

Strike Price: $35.00

The strike price is $1.45 (3.98%) lower than the current price.

A strike price below the current price (out-of-the-money) reduces the probability of assignment and provides a buffer against short-term downward moves.

3. Short Time to Expiration (DTE 28)

All three trades have 28 days to expiration.

Shorter-dated options reduce exposure to market volatility and allow you to collect premium faster. It also means quicker capital turnover if the trade expires worthless.

4. Momentum and Price Behavior

MSTR: The price is up $16.48 (4.20%) on the day. This bullish price action may suggest strength and reduced probability of a sharp decline.

YINN and SMCI are down for the day, but the downside is moderate. Premiums tend to increase during slight pullbacks due to higher implied volatility, which makes these trades more attractive for put sellers.

5. No Earnings Risk (Earnings "N")

SMCI Earnings scheduled on December 19, 2024, before expiration

Why These Factors Matter for Cash-Secured Puts:

High Premiums: Provides excellent risk-adjusted returns.

Strike Below Current Price: Offers a buffer and margin of safety.

Short Expiration: Limits exposure to volatility while allowing for faster option premium collection.

No Earnings: Removes a common source of uncertainty and risk.

Summary:

These trades align well with a cash-secured put strategy because of the high APYs, strike price buffer, and short DTE. If you are comfortable owning these stocks at the strike price (if assigned), these positions present attractive income opportunities while managing downside risk.

📈 My Technical Analysis of Cash-Secured Put Candidates: MSTR, YINN, and SMCI:

To determine which stock is the best candidate for a cash-secured put strategy, I will compare them across the following criteria:

Trend Alignment

Implied Volatility (IV Rank)

Probability of Expiring Worthless (POW)

Annualized Return

Liquidity (Bid/Ask Spread)

Earnings Considerations

1. MSTR (Microstrategy Inc.)

Trend: Bullish (1M and 6M trends align).

IV Rank: 30 (neutral level).

Probability of Expiring Worthless (POW): 49.35% (slightly low, indicating moderate risk of assignment).

Annualized Return: 312.90% (very high).

Liquidity: Very liquid (tight bid/ask spread: $37.47 mid-price).

Earnings: None before expiration.

Premium: $3,747 for a $390 strike, breakeven at $352.53.

Pros:

Strong bullish trend.

High annualized return and excellent liquidity.

No earnings risk.

Cons:

Low POW indicates nearly a 50/50 chance of assignment.

Verdict: A strong candidate due to the bullish trend, strong liquidity, and high annualized return. The POW is not ideal but compensated by the upside potential.

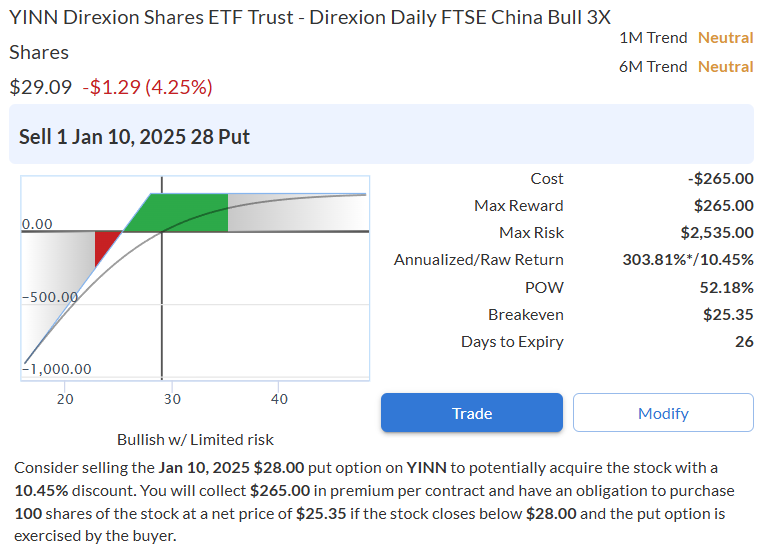

2. YINN (Direxion Daily China Bull ETF)

Trend: Neutral (both 1M and 6M).

IV Rank: 18 (low, indicating less premium potential for sellers).

Probability of Expiring Worthless (POW): 52.19% (better than MSTR but still modest).

Annualized Return: 303.81% (very high).

Liquidity: Poor liquidity (wide bid/ask spread: $2.00–$3.30, high slippage risk).

Earnings: Not applicable (ETF).

Premium: $265 for a $28 strike, breakeven at $25.35.

Pros:

High annualized return.

No earnings risk (ETF).

Cons:

Neutral trend reduces directional confidence.

Poor liquidity makes execution and exit difficult.

Relatively low premium.

Verdict: Not a strong candidate due to liquidity issues and neutral trend. The high annualized return is less compelling with such poor spreads.

3. SMCI (Super Micro Computer Inc.)

Trend:

1M: Mildly Bullish

6M: Bearish (trend conflict).

IV Rank: 48 (high, favorable for selling puts).

Probability of Expiring Worthless (POW): 48.96% (similar to MSTR, moderate risk of assignment).

Annualized Return: 301.58% (very high).

Liquidity: Fair (bid/ask spread: $3.20–$3.40).

Earnings: Earnings scheduled on December 19, 2024, before expiration (increased risk).

Premium: $330 for a $35 strike, breakeven at $31.70.

Pros:

High annualized return.

Elevated IV Rank supports high premiums.

Cons:

Bearish 6M trend raises downside risk.

Earnings before expiration introduces volatility.

Liquidity is not as tight as MSTR.

Verdict: Moderate candidate due to trend conflict and earnings risk. While IV Rank and return are strong, the bearish trend reduces confidence.

Comparision Table:

Conclusion:

Best Candidate: MSTR (Microstrategy Inc.)

Reasons:

Strong Bullish Trend: MSTR has both 1-month and 6-month bullish trends, aligning with the direction of the strategy.

High Annualized Return: 312.90% return compensates for the risk.

Excellent Liquidity: Tight bid/ask spreads ensure efficient execution and lower slippage.

No Earnings Risk: No earnings before expiration reduces uncertainty.

While the POW is slightly low at 49.35%, the overall reward-to-risk ratio, strong trend, and liquidity make MSTR the superior choice.

Decision:

I would trade the MSTR cash-secured put.

I would not trade YINN due to liquidity and neutral trend issues.

I would hesitate on SMCI due to trend conflict and earnings risk and I’m not sure if I want to own it if assigned.

📌 My Take:

Cash-secured puts are a great strategy for generating consistent income, but you have to be selective. It’s not just about the premium—it’s about the trend, breakeven cushion, and liquidity.

MSTR stood out as a strong, well-rounded candidate. If assigned, the ability to sell covered calls adds another layer of income, making this strategy a powerful income generator however the collateral is sizable at over $35,000 which can be a factor to many traders and investors.

Your Turn – Ready to Find Your Next Trade?

Now you’ve seen how I evaluate cash-secured put opportunities—from scanning for premium to analyzing the technicals. If you’re looking for consistent income and the potential to build wealth through assigned stocks, this strategy is worth mastering.

Keep your risk in check, focus on quality setups, and remember—each trade should align with your broader investment goals.

Until next time stay Disciplined, Trade Smart, and Let the Premium Roll in In.-EC

*Disclaimer The examples and information in this article are for educational purposes only and not financial advice

Looking For More Trade Ideas? Follow Me on Twitter/X EdwardCoronaUSA

Is there a way to scan for stocks that have a High Annualized Premium Yield (APY)?

Are you sure SMCI has earnings scheduled for December 19th? I have an active SMCI trade and wonder if I should consider closing it before December 19th.