My Options Trading Pick For Tuesday, April 30, 2024, Is Now Live.

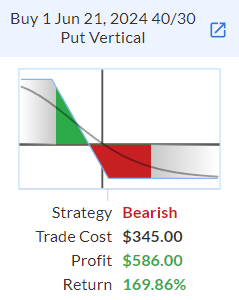

$SPHR is bearish with a wide window to support if It can break down below its 200-day MA. I'm going to risk $345.00 per contract for a potential $586.00 profit, a 169.86% return.

Technical Summary: The stock has underperformed the market when compared to the S&P 500 over the last 50 trading days. SPHR's chart formation indicates the stock is in a strong downward trend.

Momentum, as measured by the 9-day RSI, is negative. Over the last 50 trading sessions, there has been more volume on down days than on up days, indicating that SPHR is under distribution, which is a bearish condition.

The stock is trading below a falling 50-day moving average which confirms the weak technical condition of SPHR. SPHR could find secondary support at its rising 200-day moving average.

🎯 My target price is $30.69 by expiry and I need to be below $36.55 for the trade to be profitable.

Strategy: Put Vertical $SPHR

Trade Breakdown:

This is a bearish strategy with a limited risk of $345.00 and a limited potential reward of $655.00. This strategy will profit if the stock closes below $36.55 by Jun 21, 2024. There is a 41.93% probability this will happen.

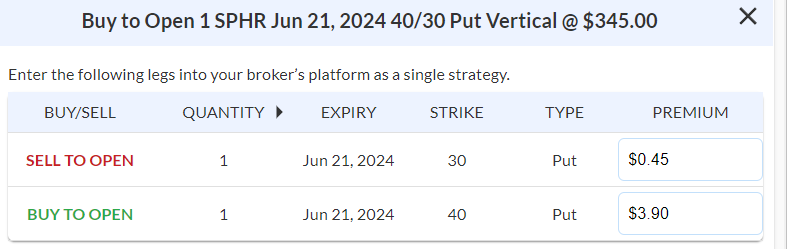

Entering The Trade:

Bid: $3.15 Mid: $3.30 Ask: $3.45 Avg Premium: $3.45

Please note that these prices were taken during market hours. If they change dramatically by the time you read this, use your discretion. Stop Loss at 50% on this trade.

$SPHR Sphere Entertainment Co

Trade Checklist:

Stock Trend: The strategy you have chosen is bearish and SPHR's 1m trend is bearish.

Market Trend: The strategy you have chosen is bearish and currently the S&P 500's 1m trend is bearish.

Earnings Date: Be aware that there is an earnings call on May 8, 2024, which is prior to the expiration of your trade.

Spread & Liquidity: The bid/ask spread of this trade is sizable, it is recommended that you place a limit order near the MID price.

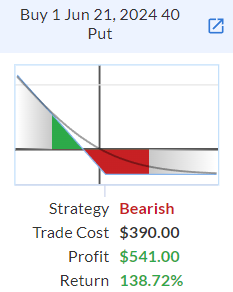

$SPHR Alternative Trade For Level I Accounts:

Trade Breakdown:

This is a bearish strategy with a limited risk of $390.00 and a limited potential reward of $3,610.00. This strategy will profit if the stock closes below $36.10 by Jun 21, 2024. There is a 39.74% probability this will happen.

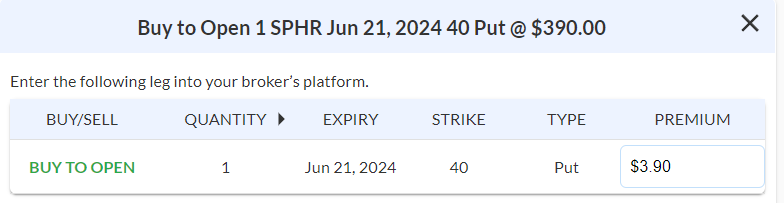

Entering The Trade:

Bid: $3.70 Mid: $3.80 Ask: $3.90 Avg Premium: $3.90

Looking For More Trade Ideas? Follow Me on Twitter Where I Post Live Price Action Swing Trading Ideas Throughout The Day EdwardCoronaUSA

@Edward Have you been stopped out on this play? Also, in general if you do get stopped out will you notify us of this in the newsletter?

Well, this doesn’t seem to be going in the right direction