✅ Take Profit Alert – April 3, 2025

Taking risk off the table with over $3,915 in profits locked in and fresh setups on deck

Today I’m locking in gains across four spreads that have each hit or exceeded my take profit threshold. These setups played out exactly as I anticipated, and there’s no reason to leave additional risk on the table.

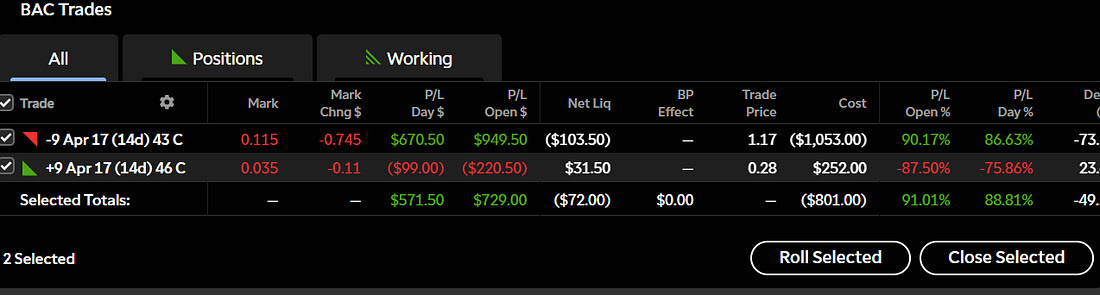

1. $BAC – Bear Call Spread (43C / 46C)

Entry: Short 43C / Long 46C

Profit: +$729.00

% Gained: +91.01% of max profit

Why I’m Closing:

BAC continues its downtrend and this spread has performed perfectly. With over 90% of the total premium captured and two weeks left, the risk/reward no longer favors holding. I'm closing to secure the win.

2. $BJ – Bull Put Spread (105P / 110P)

Entry: Short 110P / Long 105P

Profit: +$789.00

% Gained: +73.46% of max profit

Why I’m Closing:

BJ is holding up well, and this spread has matured into a high-probability win. With over 73% of the credit collected and 14 days left, I’m exiting while the trade is well in the green.

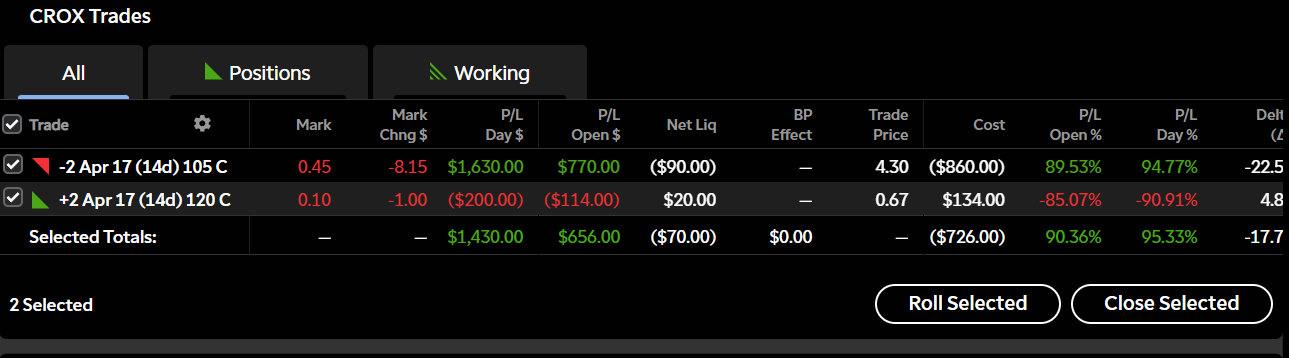

3. $CROX – Bear Call Spread (105C / 120C)

Entry: Short 105C / Long 120C

Profit: +$1,430.00

% Gained: +90.36% of max profit

Why I’m Closing:

CROX rolled over hard after tagging resistance, and the fade continues. With over 90% of max profit in hand and momentum still in my favor, I’m exiting the trade before any potential snapback. It’s textbook risk removal.

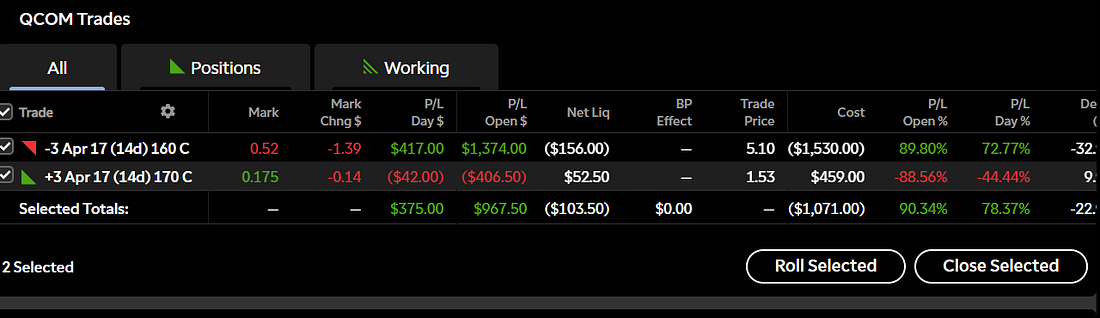

4. $QCOM – Bear Call Spread (160C / 170C)

Entry: Short 160C / Long 170C

Profit: +$967.50

% Gained: +90.34% of max profit

Why I’m Closing:

QCOM failed at its moving averages and continues to weaken. With over 90% of the premium collected and little left to gain, I’m closing this one out ahead of schedule and locking in profits.

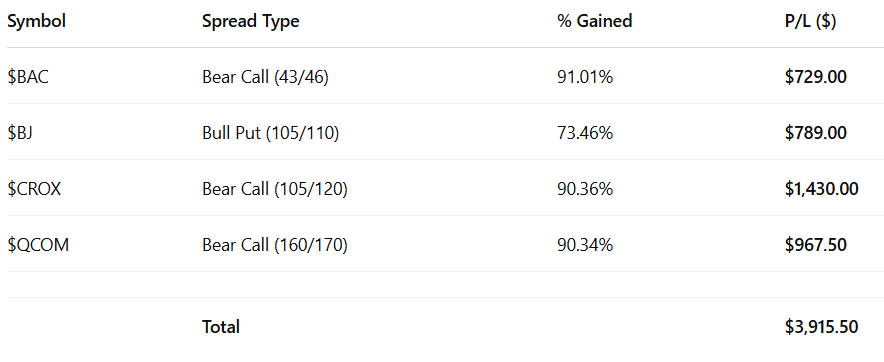

Closing Summary:

Four trades closed, $3,915.50 in realized gains, and risk off the table. I’ll be evaluating new setups shortly.

*Disclaimer: The examples in The Options Oracle are my opinion, not financial advice.

Looking For More Trade Ideas? Follow Me on X at EdwardCoronaUSA