✅ Take Profit Alert on DFS: Wednesday, April 9, 2025

Closing DFS Call Credit Spread — 86.2% of Max Reward

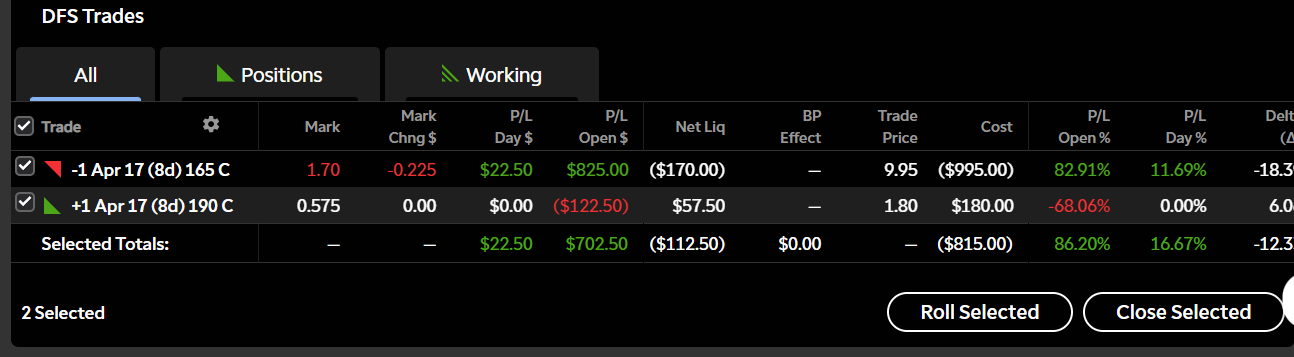

📝 Trade Breakdown:

Strategy: Bear Call Spread

Underlying: Discover Financial Services ($DFS)

Strike Prices: Short 165 Call / Long 190 Call

Expiration: April 17, 2025 (8 days remaining)

Entry Credit: $8.15

Max Risk: $16.85

Max Reward: $815 per spread

Current Profit: $702.50

86.2% of Max Premium Captured

💡 Why I’m Closing:

This trade has done its job.

DFS remains in a downtrend, and the stock is trading nearly $19 below the short 165 strike. Technicals continue to show weakness, but with only 8 days to expiration and over 86% of max profit already captured, the remaining premium just isn’t worth the risk of a reversal or a volatility spike.

The IV Rank is still high, and I don’t need to give the market another full week to take this away from me.

When a high-probability trade like this one delivers most of the reward ahead of schedule, I prefer to close the position and move on to the next setup with fresh capital and a clean slate.

📬 Want Setups Like This Delivered Daily?

If you found this helpful and want to receive high-probability trade setups like this one every day, straight to your inbox — along with technical analysis, strike price, and trade management updates — consider becoming a paid subscriber to The Options Oracle.

I break down the reasoning behind every trade I take and walk you through the entire process from entry to exit.

🔒 Upgrade to a paid subscription here and start trading with an edge.

*Disclaimer: The examples in The Options Oracle are my opinion, not financial advice.