✅ Take Profit Alert, Tues. 5/27 – AEM Bull Put Spread +51%

Locking In Gains and Freeing Up Capital

$AEM Bull Put Credit Spread

Trade Breakdown:

Max Profit Potential: $1,004

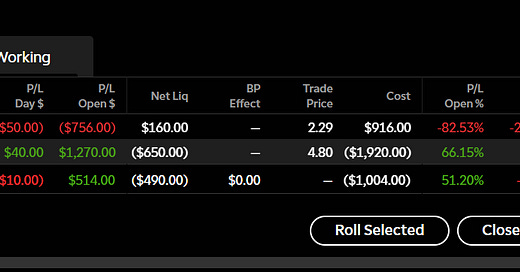

Current Profit: $514 (51.20% of Max Gain)Closing the spread and booking profits. The short 112P has gained $1,270 since opening, while the long 105P has lost $756 — net result: $514 locked in and no more exposure to downside risk or potential upcoming volatility.

Why I’m Closing Now:

I’ve captured just over 50% of the max gain with 17 days left — and for gold-related stocks like $AEM, that’s usually where I draw the line.

Gold names are volatile. They can run, but they can also reverse fast — and I’ve learned the hard way not to get greedy. I tend to close these trades out once I hit 50% profit, especially when there’s still time left on the clock.

On top of that, $AEM has an ex-dividend date coming up on May 30, which could inject even more short-term volatility into the price. There’s no need to hold this and risk giving back gains to chase the remaining $490.

This was a clean trade, and it did exactly what I wanted. Time to book it and rotate.

📬 Want Trade Setups Like These Sent to You Daily?

If you want to receive high-probability trade setups like this one every day, straight to your inbox — along with technical analysis, strike price, and trade management updates — consider becoming a paid subscriber to The Options Oracle.

🔒 Upgrade to a paid subscription here and start trading with an edge.

*Disclaimer: These trades reflect my own strategy and opinion, not financial advice.

This is good stuff.