✅ Take Profit Alert: Tues. 7/8/25 $AAP Bull Put Spread 85+% Captured

Taking Profit To Avoid a Potential Pullback

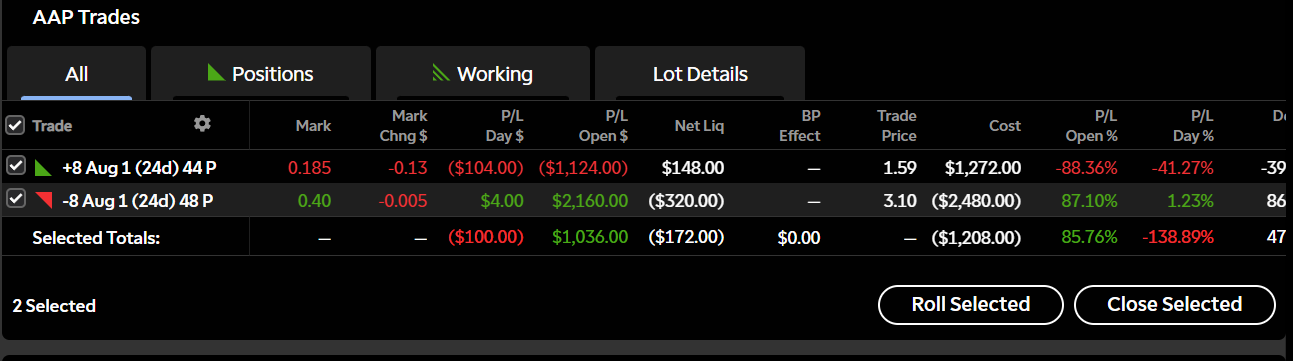

I’m closing out the $AAP August 1st $48/$44 bull put spread for a solid gain — and here’s why this makes sense right now.

📈 The Chart:

AAP has followed through beautifully. Price just hit a new swing high at $55.75, breaking out with strength and solid volume. It’s well above both strikes, and the breakout candle confirms momentum is back in charge.

Price is now well above the 10-day, 50-day, and 200-day SMAs

RSI is at 69, nearing overbought

Stochastic is at 83, also in overbought territory

MACD is curling back up, but hasn’t fully expanded yet — so upside is still possible, but may need to cool off soon

Put simply, this move has played out — and then some.

💰 The Trade Breakdown:

$AAP — 48/44 Bull Put Spread (Aug 1 Expiration)

Net P/L: +$1,036.00 (+85.76%)

Days to Expiration: 24

Current Price: $55.75

🧠 Why I’m Closing:

I’ve captured the majority of the premium and the price is nearing short-term exhaustion levels

The breakout happened, and I’m up +85.76% on the spread — closing while liquidity is good makes sense No reason to sit through the next 24 days hoping nothing reverses

The risk-to-reward here is no longer favorable. The lion’s share has been made

📬 Want Trade Setups Like These Sent to You Daily?

If you want to receive high-probability trade setups like these every day, straight to your inbox — along with technical analysis, strike price, and trade management updates — consider becoming a subscriber to The Options Oracle and start trading with an edge.*Disclaimer: These trades reflect my own strategy and opinion, not financial advice.