Walgreens Boots Alliance Breaks Out: A New Chapter in Its Turnaround Story

After back-to-back quarters of growth and a stunning post-earnings rally, is WBA finally on the road to recovery?

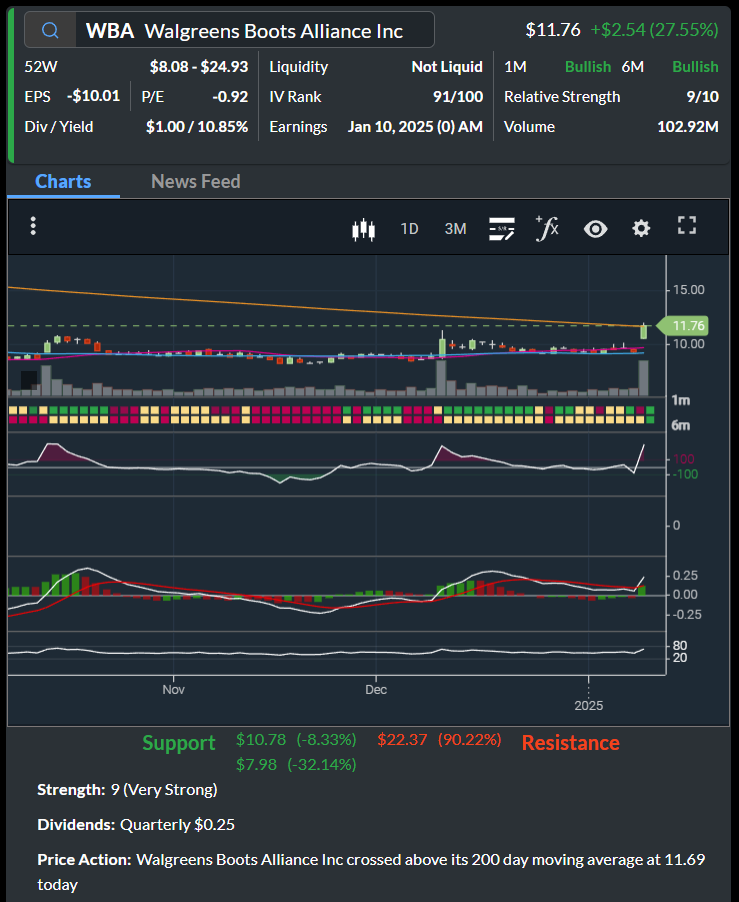

Hi everyone, and welcome back! Today, I want to share a fascinating story and technical analysis of Walgreens. Walgreens Boots Alliance ($WBA) has had a tough time recently. After plunging more than 65% last year, the stock seemed stuck in a downward spiral as the company grappled with tough retail conditions and fierce competition. But things may finally be starting to turn around.

With its Q1 results, $WBA posted a stunning 27.55% rally in one day, hitting levels not seen in the past five months. What’s behind the turnaround, and is there more room for optimism? Let’s take a closer look.

Earnings That Delivered a Surprise Boost

First, let’s talk about the numbers. In Q1, adjusted EPS fell by 22.7% year-over-year to $0.51, but that drop wasn’t as bad as analysts were expecting. Meanwhile, revenue grew by a solid 7.6% to $39.5 billion, even accelerating from the previous quarter’s 5.9% growth.

Key takeaways from the earnings report:

Pharmacy Sales: The star of the show, pharmacy sales soared by 10.4%, supported by higher branded drug inflation and prescription volumes.

Retail Sales: On the flip side, retail sales struggled, falling 6.2%, with comps down 4.6% due to a weaker flu season and ongoing struggles in discretionary categories.

International Segment: A bright spot in the report, with sales jumping 10.2% year-over-year, driven by strong performances at Boots UK pharmacy and retail.

U.S. Healthcare Growth: Divisions like VillageMD and CareCentrix posted impressive growth of 9%, 16%, and 30%, respectively.

The company also reiterated its FY25 earnings outlook of $1.40-$1.80 per share, banking on benefits from cost-cutting initiatives and strength in its U.S. pharmacy services.

Strategic Moves Amid Challenges

Let’s not sugarcoat it—Walgreens still has a long road ahead. The retail side of the business remains under pressure, with shifting consumer behaviors and inflationary impacts taking their toll. As a response, Walgreens is streamlining its operations:

Store Closures: The company announced plans to close 1,200 stores over the next three years, with 500 set to close this fiscal year.

U.S. Healthcare Simplification: Walgreens is reviewing its healthcare investments, including exploring a sale of VillageMD, to focus on profitability and streamline operations.

While these moves are tough, they reflect a focus on long-term stability. In fact, Walgreens expects the store closures to be immediately accretive to profitability, a silver lining amid the struggles in its retail segment.

What the Chart Says: A Technical Perspective

Here’s where things get even more interesting—the chart.

$WBA broke out above its 200-day moving average, a key technical level that signals a potential shift into a longer-term uptrend. This breakout was backed by huge volume (102.92M shares), adding credibility to the move.

Other key observations:

Momentum Indicators: The MACD shows a strong bullish crossover, and the RSI is climbing rapidly. However, it’s approaching overbought levels, so some short-term caution is warranted.

Support Levels: $11.69 (200-day moving average) and $10.78 are the key support zones to watch if the stock pulls back.

Resistance Levels: The next psychological resistance is around $15.00, with a long-term target near $22.37.

Where Do We Go From Here?

So, what’s the outlook? Let’s keep it grounded.

Short-Term Caution: A single-day rally of 27.55% is impressive, but it’s also steep. Stocks often retrace after such massive moves, so waiting for a pullback to support levels like $11.69 might be a smarter entry point.

Post-Earnings IV Decline: Implied volatility is still sky-high, making it a great time to sell options premium (think credit spreads or cash-secured puts). But with earnings in the rearview mirror, IV is likely to deflate soon.

Turnaround in Progress: The earnings report shows progress, especially in pharmacy and international segments, but challenges in retail are likely to linger in the coming quarters.

Suggestions, Not Predictions

For traders:

Stock Buyers: Look for pullbacks to $11.69 or $10.78 for a better entry. The breakout is strong, but patience might pay off.

Options Sellers: High IV makes selling premium strategies attractive, but act quickly before volatility starts to normalize.

Options Buyers: Be cautious. Expensive options due to high IV could lose value fast if the stock consolidates.

For investors:

Walgreens’ progress is encouraging, but it’s still in the middle of a tough turnaround. Keep an eye on how the company executes its cost-cutting and healthcare simplification plans over the next few quarters.

The Bigger Picture

Walgreens’ rally might feel like a victory lap, but the journey is far from over. What we’re seeing is the first glimmer of stabilization after a period of significant challenges for the company. Earnings upside, strong pharmacy sales, and cost-cutting efforts are creating a solid foundation, but challenges in retail and the U.S. healthcare portfolio remain hurdles to watch.

For now, $WBA has made a strong case for a comeback. Whether that momentum continues will depend on how well it executes its turnaround strategy in the quarters to come. Until next time, stay disciplined, stay profitable, and trade smarter! 🎯-EC

This wraps up the story behind Walgreens’ big day. As always, it’s essential to approach every trade with a clear plan and stay disciplined. Let me know your thoughts or if you’d like to explore specific trade ideas based on this analysis!

*Disclaimer The examples and information in this article are for educational purposes only and not financial advice

Looking For More Trade Ideas? Follow Me on Twitter/X EdwardCoronaUSA