🎯 Weekend Deep Dive: Target (TGT) Just Missed the Mark… Again

Sales Slump, Margin Mayhem & What the Chart Tells Me Next

May 25, 2025

Hey traders and investors,

Earlier this week, Target ($TGT) stumbled hard after delivering a Q1 earnings report that, frankly, missed the mark — badly. This wasn’t a one-off slip either. That makes two sizable EPS misses in the last three quarters. It’s like déjà vu, and not the good kind.

Revenue came in lighter than expected at $23.85 billion, down 2.8% year over year. But what really caught my eye was the 3.8% drop in same-store sales. Traffic was down, ticket size was down, and confidence? Yeah, that’s down too. Even digital comps — the bright spot — are slowing from earlier strength.

Margins got crushed, sliding to 3.7% from 5.3% last year. Tariffs, markdowns, and excess inventory adjustment costs didn’t help either. And they’ve already warned Q2 isn’t going to be any prettier.

So with all that bearish sentiment, what’s the chart telling me? Let’s dig into it.

🔍 Technical Breakdown

I’m going to walk this one through slowly. Whether you’re new to charts or a seasoned trader, I want to make sure you see all the findings. Let’s break it down from the top

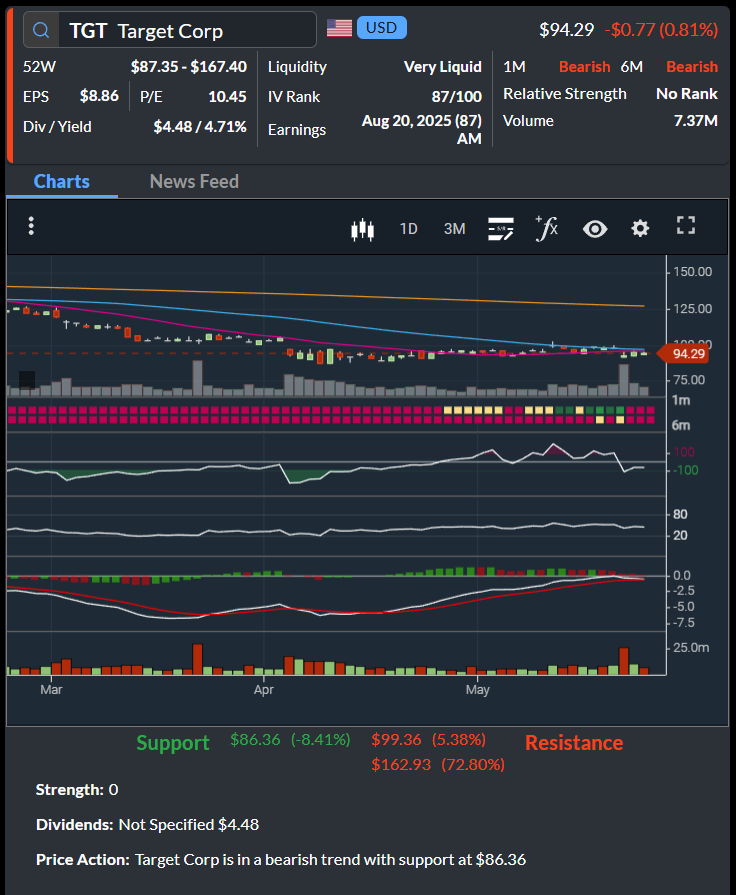

🔻 Price Action

Target closed Friday at $94.29, down -0.81% for the day. It’s been on a clear downtrend for months, and the failed attempts to break back above the 50-day and 100-day moving averages have kept the pressure on.

The current trend is bearish across the board — short, medium, and long-term. That’s a red flag for anyone thinking about jumping in early.

📉 Moving Averages

Here’s what you need to know:

20-day MA (short-term) is pointing downward and well above price.

50-day MA is acting like a lid — price keeps tapping it and failing.

200-day MA is up at ~$125, miles above current levels. That’s a reminder of just how far this thing has fallen.

Price is below all key MAs. That’s the textbook definition of a stock in a downtrend.

🧭 Relative Strength Index (RSI)

RSI is hanging out below 50 and starting to curl lower. That shows weak momentum — no real buying strength behind recent candles.

If RSI drops below 30, we may enter oversold territory, but right now it's still just weak, not washed out.

📊 MACD (Moving Average Convergence Divergence)

The MACD line is curling down, and we’ve got a fresh bearish crossover forming. That’s a momentum shift to the downside.

Not great for bulls. That cross tends to be a lagging confirmation, but paired with everything else, it reinforces the trend.

🔎 Volume

Volume spiked after earnings — and not in a good way. Heavy red bars showed sellers were in control, confirming the breakdown.

That kind of volume validates the move. It’s not just weak hands selling; this looks like institutional unloading.

💡 Support and Resistance

Key support: $86.36 — that’s the level I’m watching. It held a couple of times recently and lines up with a prior base.

Resistance zones: $99.36 is your first real ceiling. If the stock gets a bounce, I’d expect that area to reject it again. Beyond that? $162.93 is the longer-term line, but that’s wishful thinking for now.

📈 IV Rank

IV Rank is at 87 — very high. This tells me the market is pricing in big moves ahead. That makes sense given the earnings drop and guidance cut.

For options trades, high IV = expensive premiums. But since I’m keeping this trade straight (no options), what this tells me is that fear is priced in. We might see some chop, but also opportunity for bounce plays.

🛠️ How I’d Trade It (Straight Stock, No Options)

For Traders

If I’m looking for a short-term setup, I want a break below that $86.36 support with volume. That’s my short trigger — breakdown confirmation.

📉 Short Setup

Entry: $85.90 (below support)

Stop Loss: $88.50

Target 1: $80

Target 2: $75

But if the stock starts basing at that support and RSI dips toward 30, I’d be open to a short-term bounce play.

📈 Long Setup (Reversal Play)

Entry: $87.00 (off support + oversold RSI)

Stop Loss: $85.00

Target 1: $93

Target 2: $98

This isn’t a “buy the dip” play right now — it’s more like “wait for proof.” So I’m not buying anything until I see actual support hold and a turn in momentum.

For Investors

If you’re a long-term investor, I’d be cautious here. The dividend (4.71% yield) is attractive, but dividend traps are real. The stock is in a downtrend, and until it bases out and reclaims the 100-day, there’s no rush.

Personally, I’d wait for price to:

Hold above $86 for at least a few weeks

Clear the 50-day with conviction

Show improved earnings outlook in Q3 or Q4

That’s when I’d consider building a longer-term position.

🧾 Final Thoughts

Target has had a rough go lately — missing earnings, slashing guidance, and losing traffic. Add tariff fears, markdown pressure, and a hit to consumer confidence, and it’s no wonder the chart looks like it does.

This is not a “buy it and forget it” stock right now. But it is one to keep on your watchlist — especially if it flushes into oversold territory. That $86.36 level is the battleground. If it breaks down, we could see more downside. If it holds, traders might get a shot at a bounce. For now, I’m staying cautious — but watching closely. Catch you on the next one! 🎯-EC

If you want daily trade setups, market commentary, and chart breakdowns like this, consider becoming a paid subscriber to The Options Oracle.

📬 Upgrade to a paid subscription here and start trading with an edge.

Remember, I also post a free morning briefing before the open and a closing summary every day on Substack Notes and X — turn on notifications so you don’t miss them!

*Disclaimer: The examples in The Options Oracle are my opinion, not financial advice.